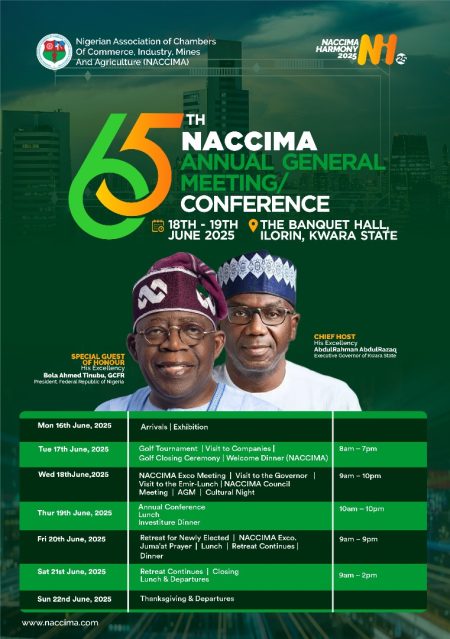

President Bola Ahmed Tinubu has introduced major tax reform proposals aimed at improving Nigeria’s tax administration. Central to these reforms is the Nigeria Revenue Service Establishment Bill, which seeks to abolish the Federal Inland Revenue Service (FIRS) and replace it with a new agency, the Nigeria Revenue Service. This new body would be responsible for assessing, collecting, and managing government revenue, with the goal of streamlining operations and reducing tax-related disputes.

Additionally, the president has submitted the Nigeria Tax Bill 2024, which aims to establish a comprehensive framework for taxation. The Tax Administration Bill is also part of the package, designed to provide a clear legal structure for fair and efficient tax law enforcement, while enhancing compliance.

To further strengthen revenue administration, the Joint Revenue Board Establishment Bill has been introduced, proposing better coordination between different levels of government. It also includes the creation of a tax tribunal and an ombudsman to handle grievances and improve overall system efficiency.

President Tinubu has urged the House of Representatives to fast-track the consideration and passage of these bills, expressing optimism that the reforms will strengthen Nigeria’s fiscal institutions and drive economic growth.